Pod Incentives

Why buying accelerating top lines has been so effective.

I don’t work at a fund and never have. Some of this might be dead wrong. But my understanding is that if you are an analyst at a pod you will be forced to justify your suggestions in meetings with your portfolio manager regularly, before the trades are made, and then consistently after.

There is certainly some alpha here if you are a retail investor/trader that doesn’t care about short term swings. It’s always good to know whose on the other side of a trade. Imagine that every day the person that determines the fate of your career is asking you “why isn’t this working” if the stock is down, or “should we sell?” now that something has repriced. At least 3 consequences of this:

1. Bias to thematic / technicals / social media as catalyst

Imagine you are Warren Buffett working at a pod today. You consistently put up 25% returns every year and so you have been slowly entrusted with more capital.

One day a new kid joins the pod, gets given 10m to manage. The new kid on the block, if you will. Block Kid’s into AI, on Discord and X all day, crypto native. Might have even pumped his own meme coin at some point. Anyway, he convinces his boss to pay for SemiAnalysis, starts reading it obsessively. You start hearing a lot of “Dylan Thinks” around the office.

One day Block Kid has an insight, or he reads someone else’s insight, it doesn’t really matter. The insight goes something like this:

There is not enough energy for data centers to grow at the rate mega cap tech wants them to.

Hyperscalers have responded by building power plants next to their data centers.

But they cannot buy enough gas turbines to even vertically integrate the power stations - lead times are too long.

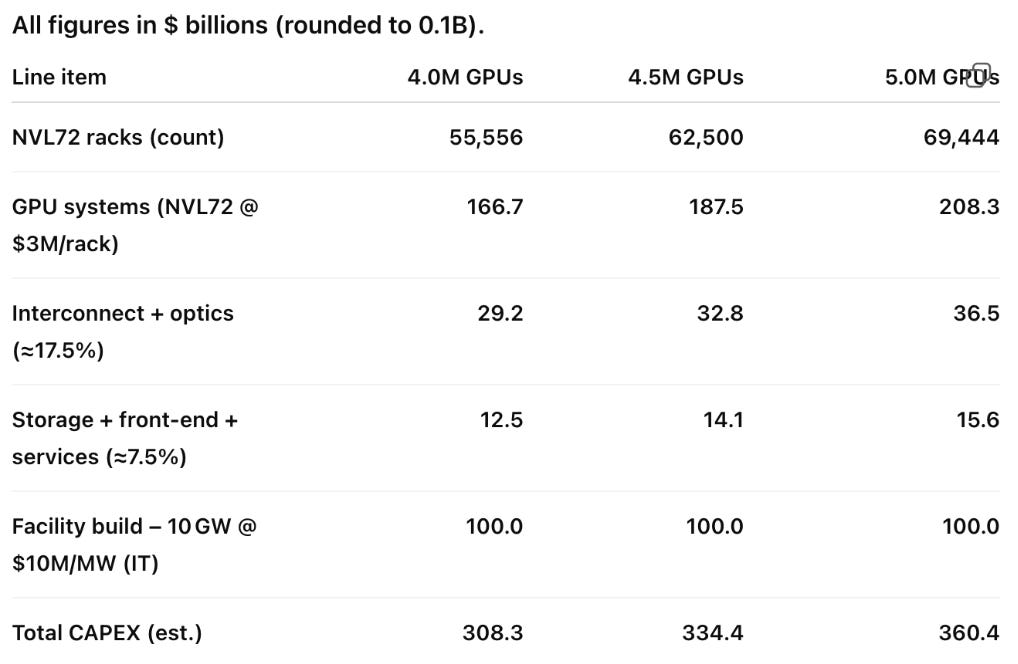

The cost of energy is relatively low relative to total data center cost.

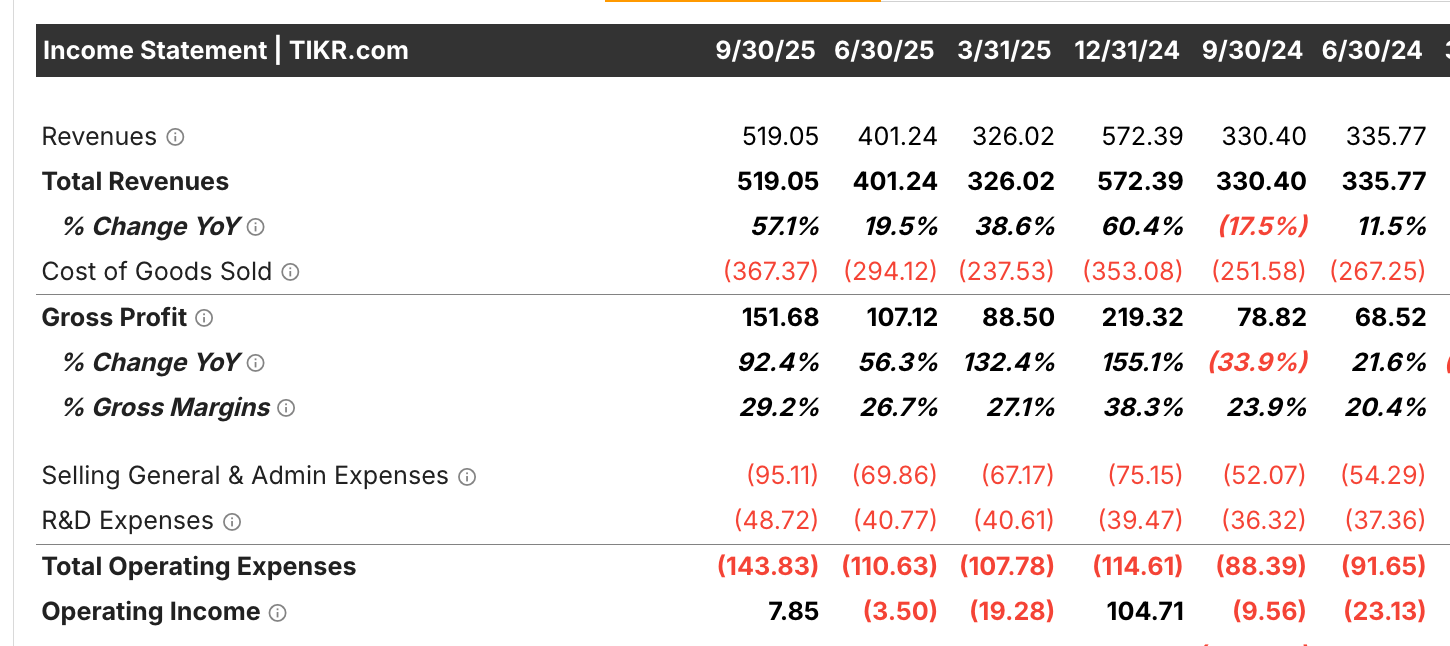

Here’s what a hypothetical 10 GW data center might cost, demonstrating the relatively small effect of electricity prices on net profitability (still nominally a fucking huge number though).

Is there a way out of this energy dilemma? Block Kid reads online that Bloom Energy ($BE) makes on site power generation. This seems like a good solution to the problem. The companies growing.. quite a lot already? Shares can be had for around $25 on June of 2025.

Block Kid is early to this trade, but not overly so - the data to confirm the thesis was there, and you could still buy the shares at around $25 after Bloom put up 60% YoY revenue growth in Q4 of 2024. At $25, we would be talking a little under $6 billion market cap, probably around 4 or 5x fwd revenue with extremely good growth and obvious operating leverage / margin expansion.

This was a prudent investment and in retrospect seems like kind of a no brainer right after Q4 earnings if you covered the name. A nice investment.

The reason I write all of this though, is that in the past, an investor might buy some shares in Bloom, then have to wait a couple years for this rev growth + margin expansion thesis to play out. The revenue growth and margin expansion is the catalyst, not the narrative.

If true growth was around 35%-40% a year, margins crept steadily upward and operating income inflected, by 2028 or so you would have a very obviously good company and should see some real price appreciation, perhaps something like a 30x earnings multiple on 500m of LTM net income, or similar, for a market cap of 15-20 billion. This would be a 3+ bagger in 3 years, without taking that much risk on - after all, you could just track data center expansion to gauge how the plan is going. You would outperform Warren here significantly with your unique insights into the Data Center market.

That’s not what happened though. From July to November 2025, very little really changed on Bloom’s side. Nvidia hit their numbers. The data center expansion continued. Bloom executed on the plan and the initial thesis was sound. But the market caught onto accelerating growth and pumped the narrative to the moon. Did all the crypto investors just start buying AI infra? Is there a hidden Discord community devoted to pumping this shit? Instead of waiting till 2028 for a 3x, Block Kid ended up 5xing in under 6 months at a peak of $133 a share.

He didn’t even have execution risk - since the market instantly repriced the accelerating top line, Block Kid could dump the stock like it was a video game NFT. There was no need to see if the thesis actually played out or not.

Today, Bloom has repriced back to $90 as part of a broader sell off in AI names. Probably, the company will eventually return to all time highs. America’s newly insatiable energy demands are a real thing. But the point stands - you simply cannot compete with thematic investors on a short time horizon.

It’s important to note the strategy works much better if you do not buy and hold.

On a 5 year time horizon, it is almost impossible for Bloom (or Palantir, or Axon, etc) to outperform SPY after they reprice like this, because the cost of capital is too high. These companies need to work their way into their current valuations over time, something I believe will eventually happen. Even though Palantir is overvalued by at least 100% (and I have been short for quite a while), I would still rather own it than a bond. 10 years from now, I would be surprised if Palantir was not worth more than it is today. It might even be worth a trillion dollars. I just don’t think it will outperform SPY, which will have compounded at least 100% over this time frame.

All of this is somewhat obvious, with thematic traders making significant amounts of money, and value investors writing long posts on X that essentially amount to a massive amount of cope. I am simply observing the dynamic, reinforcing my ideas - that there is a strong bias to give the person that can quickly turn over accelerating toplines a lot of money, and that if you have a longer term point of view, this will inevitably lead to pricing inefficiencies. After all, these professional investors are meant to be the ones making the market efficient! And yet they have clear biases. What else?

2. Selling losers too quickly.

When a stock ‘isn’t working’, your intuition is going to take a back seat to short term data and price action. It is just inevitable. Your life experience leading up to this moment has told you ‘i think this is probably going to work’ but the short term data and perhaps more pressingly, the price action, says ‘eh’. There is no real way to defend this to your boss who will want a clear layup. You simply do not want to bet your job on 10 names a year, and that is going to be what the stakes feel like.

This means you are going to cut losers faster than you should. It doesn’t mean the overall strategy of investing in a pod format is not effective. But there is no doubt in my mind that cutting losers too quickly is just a natural consequence of the strategies incentives.

Imagine you bought Constellation Brands at $170 a share (I SAID ONLY IMAGINE MARTIN!). It drops to $130. Your boss comes in and says “why isn’t this working?”. You show him a spreadsheet, outlining how by 2032 its quite likely your firm will own the entire company if it does not reprice upward. In fact you tell him, the position being down so much is actually good for your thesis, and that your initial target had been 2034.

You are now unemployed.

3. Selling winners too quickly

When a stock is working, you are going to sell too fast regularly. Again, the overall strategy can work. Selling too fast is not inherently bad, especially if, fueled by Zyn and Adderall, you can quickly generate ideas by working every waking hour in your attempts to escape post-AI servitude. And as we discussed earlier, if your whole strategy is predicated on buying accelerating toplines and then quickly selling to remove all execution risk, you SHOULD sell quickly.

But if it is only a little more +EV to hold vs turning over your capital again, you are going to be ‘take the win biased’, because if the stock retraces, you are going to look like an idiot to your boss.

If a stock continues to run, you will look a bit stupid for having sold, but not in the same way as if you retraced a 50% gain. Furthermore, because everyone in the industry views your trading profits on a pre-tax basis, the bragging rights (and hence the ability to manage more power and capital at work) go to those who put up the highest pre-tax numbers (a characteristic shared on X).

It is just kind of small dick energy to talk about how, on a post-tax basis, you actually did pretty well. No one talks about how Ted Weschlers Peninsula Fund almost never generated a taxable gain across its entire lifespan. Most people just look at the overall % return and compare it to other funds. Well, no one except Warren Buffett, and now Ted manages somewhere between 20 and 40 billion at Berkshire. So, truth does rise sometimes, but i digress.

Final Thoughts

So, three consequences of the pod model. A heavy bias to accelerating toplines and thematic stories. A heavy bias to quickly selling winners. And 0 patience for losers.

If we understand these dynamics, we can see market inefficiencies that will be created. Here are some off the top of my head

Any stock without an accelerating topline is going to be under held on social media. You simply cannot own Dominos Pizza at a pod, it is not thematic enough, and it is never going to beat huge. If you want to own stocks like this, you need to have patience. That might be enough for you to not own them. The important idea is to know what game you are playing.

If a stock has a call option on a new revenue line (and thus, has the potential for an accelerating topline), this makes the call option more valuable. You are seeing something significantly before the market, and if it works out, you are going to get PAID.

If a stock can become thematic, this can serve as a repricing catalyst. Take for example, breast implants. Could breast implants become thematic based on increasingly realistic humanoids? (personally I don’t think so, having to deal with the FDA for your sex bot is -EV).

Stocks will become regularly oversold. No one wants to see a bunch of red waiting to reprice on their book, but if you are being questioned daily on why stuff is not working, you are just going to dump losers at any price and hope for a big earnings win on a new position to save your year rather than waiting for small shifts upwards in your losers. Big dick energy isn’t looking at a bunch of losers on your book while you hope for them to retrace to your cost basis, its cutting all of it and betting the farm on a trend toward an increasingly Conservative Latin America that will show up in the news cycle in 7 weeks.

Despite all this, I do think it is worth leaning into the thematic investing at times. Outperformance with this strategy is replicable - just need to know what game you are playing. The biggest lesson i’ve had investing in some of the more reasonable names in data center, drones, space, etc, is it is often wrong to wait for LT capital gains to kick in, for the reasons i’ve outlined above.

In closing, I will say, there is a major positive to the pod research model - you really do need to know your shit if your boss is going to grill you about every angle before you can put a position on, grill you about it when it drops 3%, grill you about it when you’re up 60% etc. You need answers and they need to be good ones.

Having now bought a massive position in Rakuten and had it not immediately work out perfectly (we drifted to +15% in a few months before an average up and a NIKKEI RESET knocked us back to our cost basis), it’s good to have clear answers for a lot of complicated questions.

Here are big ones that pop into my mind (i do know the answers most these):

What does the bull case look like here? How much can we actually make if everything works out?

How much debt does Rakuten have, looks like they hide a lot.

What is real operating cash flow?

What % of capex is expansion vs maintenance in the mobile business?

How hard do earnings inflect if we make it to 10m subscribers? How about 12m? How about 15m? How about 20m? Is there some way to show the operating leverage easily so we can think faster on our feet when repricings happen? EG every 1m subs is worth 150m in operating profit?

Rakuten is growing revenue and cutting expenses - how is this affecting margin expansion? How far can the cuts go? What can’t be cut?

Who is losing market share if we are gaining it? Who is weak?

Does Rakuten own distribution centers like Amazon? How has their market share changed over time against Amazon? Are we slowly winning against Amazon or slowly losing?

You’ve said Rakuten will be an AI winner and that they have a lot of data because of their broad ecosystem, where you might have a users shopping habits, credit card information and mobile plan all attached to one userID. How? Where will we see this in the top line?

You’ve said Rakuten will be an AI winner and this will lead to lower expenses. How? Where? Any sign of this?

Rakuten has a deal with KDDI until 2026 for roaming in areas without coverage. How does this change earnings once we’re out of the deal? Are we on track to get coverage in those areas?

Rakuten Viber is a messaging app, can it be monetized in the same way as WhatsApp? How much of a social media app can it be, vs just being used with Raktuen Mobile? How many subs does it actually have?

How many Rakuten Mobile retail locations are there in Japan? How does this compare to Softbank?

Rakuten has a cloud business. How does this work? I’m assuming its not like, Google Cloud right?

Rakuten has a deep relationship with Google, how does this work?

Any unusual data sources we can use for Alpha? U-NEXT is a partner, can we get a read through on Rakuten mobile subs before Rakuten reports? How about government wireless data per region?

Answering these sorts of questions will be a theme going forward in my Substack, with my next article being on Rakuten. In the future I will aim to first write up a name in fairly comprehensive detail, but then relentlessly seek out the remaining answers, as if I was my own manager. Over time, I expect to provide coverage for around 20 names over the next year. This would be around 30-40 articles per year, on top of my end of month recaps, which I think is about right / the max for me, as I am still working a massive amount on my InvestTech app, GTOPort. Stay tuned for more on that!